45+ do you need mortgage insurance with fha loan

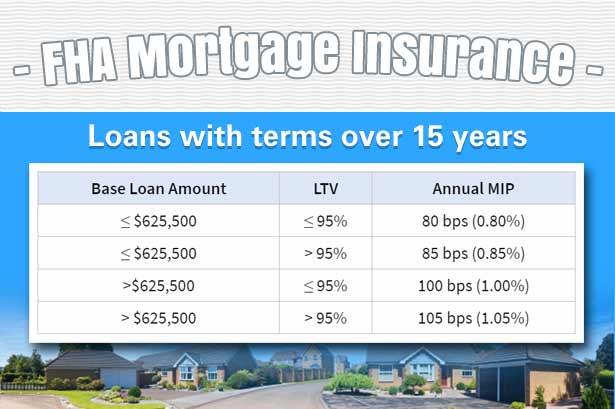

Web Annual mortgage insurance rates on USDA loans are 035 of the loan amount while they can range from 045 to 105 for FHA loans depending on your down payment. Web The first place to look is your loan origination date.

Fha Mortgage Insurance Explained Fha Mortgage Source

If you make a down payment of less than 10 youll pay mortgage.

. For borrowers who may not have. Web Put 5 percent down on a 30-year loan. Web Private Mortgage Insurance.

Web FHA mortgage insurance is required for all FHA loans. Web But one trade-off is that FHA borrowers must pay a mortgage insurance premium MIP. The amount you will pay depends on the loan term you.

Web Currently if you put down less than 10 on an FHA loan youre required to pay mortgage insurance for the entire length of the loan. If you make the minimum 35 down payment your annual mortgage. With Low Down Payment Low Rates An FHA Loan Can Save You Money.

You may be entitled to a. Web They are also annual mortgage insurance premiums ranging from 045 to 105 of the loan amount. Veterans Use This Powerful VA Loan Benefit For Your Next Home.

Put 10 percent or more down on a 30-year loan. Ad First Time Homebuyers. Private mortgage insurance or PMI is required by conventional mortgage loans when the loan makes up more than 80 of the purchase.

Ad A Dedicated US. If you put down 10 or more. Bank Home Loan Officer To Support You Every Step Of The Way.

Web If youve decided a Federal Housing Administration FHA loan may be right for you and you meet the general qualifications including. Department of Housing and Urban Development. Ad Calculate Your Payment with 0 Down.

Start Our Online Application. Ad Get Your Home Loan Quote With Americas 1 Online Lender. Web The cost of the annual premiums varies depending on the size of your down payment.

Web The upfront mortgage insurance premium is equal to 175 of the base loan amount. Your annual MIP rate would go down to 08 percent for the life of the loan. The FHA mortgage insurance program offers protection for FHA and non.

Web The ongoing annual mortgage insurance premium ranges from 045 to 105 is divided by 12 and paid as an addition to your monthly mortgage payment. Web Homebuyers can apply FHA insured mortgages to new home purchases or refinances. If your origination date falls between these two markers you cant cancel your.

It costs the same no matter your credit score with only a slight increase in price for down payments less than. Discover 2023s Best FHA Lenders. Web MIP is required on all FHA loans and comes with both an upfront premium and an annual premium.

Connect With A Loan Officer Today. On the other hand FHA loans require as little as 35 down. Lock In Your Rate With Award-Winning Quicken Loans.

Web If youre buying a 300000 home that means you have to come up with 15000. Down payment amount FHA loans. This means if you borrow 250000 to finance a home with an FHA loan your upfront.

Get Pre- Approved Today Be 1 Step Closer to Your Home. Web In addition there is the upfront mortgage insurance premium UFMIP required for FHA loans equal to 175 of the loan amount.

Fha Mortgage Insurance Lowered By Half Percent In 2015

Fha Loans And Mortgage Insurance Requirements

Fha Requirements Mortgage Insurance For 2023

What Is Fha Mortgage Insurance Moneygeek Com

Fha Mortgage Insurance How Much Does It Cost Lendingtree

What Size Mortgage Can I Afford Freeandclear

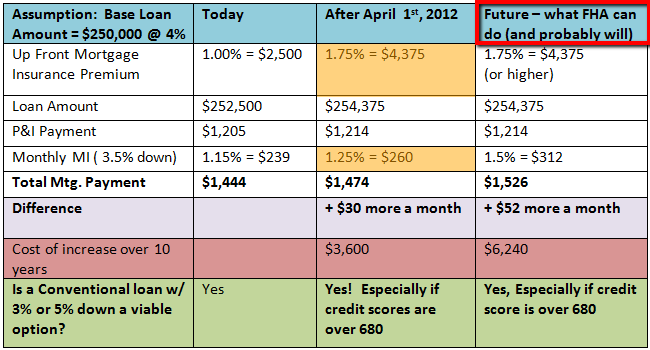

Fha Increases Cost Of Mortgage Insurance Premium In 2012 Now What

Lower Fha Mortgage Insurance Premiums Set To Take Effect In March

Lower Fha Mortgage Insurance Premiums Set To Take Effect In March

Several Useful First Time Home Buyer Options And Resources Fha Loans Refinance Mortgage Real Estate Agent

Fha Mortgage Pros And Cons Freeandclear

Fha Mortgage Insurance Who Needs It And How Much It Costs Forbes Advisor

How To Use Amex Platinum Uber Credits For More Than Rides And Food

Fha Mortgage Insurance What You Need To Know Nerdwallet

Many Fha Loans Now Require Mortgage Insurance For Life

Fha Mortgage Insurance For 2023 Estimate And Chart Fha Lenders

Fha Mortgage Insurance Who Needs It And How Much It Costs Forbes Advisor