Crypto sale tax calculator

We support hundreds of exchanges blockchains and wallets. Her success is attributed to being able to interpret tax laws and help clients better understand them.

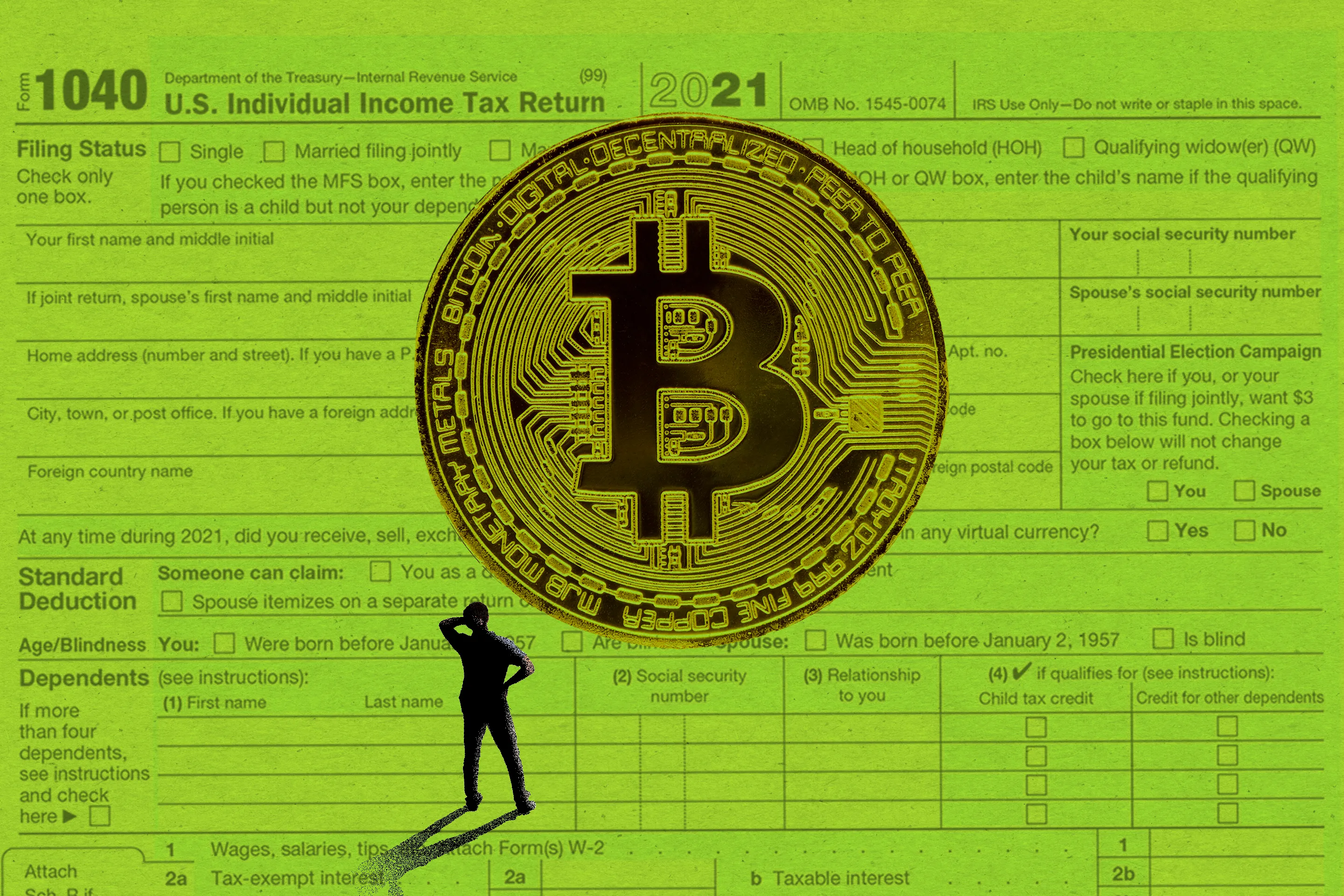

Best Crypto Tax Software Top Solutions For 2022

The use of this website is not to be constitute intend or to be considered tax advice financial advice legal advice or tax.

. Investment Initial Coin Price Selling Coin Price Investment Fee Exit Fee Write the total amount of USD you have invested in the Investment area. CryptoTaxCalculator helps ease the pain of preparing your crypto taxes in a few easy steps. This calculator only provides an indicative estimate based on data you have input and the tax brackets and rates found on the ATO.

Enter your states tax rate. Input your state tax rate. When you sell an asset for a price lower than when you bought it this is recorded as a capital loss.

If not manually edit the data to correct it. Enter your income for the year. The Result is.

Ad Start trading crypto today get instant access to more than 250 coin token markets. Calculations are estimates based on the tax law as of Feb. Proceeds From Sale Of Crypto Gain Type CALCULATE CALCULATE Estimated Capital Gain 0.

If you have the calculator will automatically apply a 50 discount to your capital gain. Decide on a crypto accounting method. Note our Cryptocurrency Tax Interactive Calculator is for estimation purposes only and allows you to get an estimate on one sales transaction at a time.

Blox free Pro plan costs 50K AUM and covers 100 transactions. The business plan comes at 99 per month and covers 10K taxations and 20 million in assets. Supports 3rd-party platforms algo trading.

Alto crypto roth IRA. Built for performance under heavy demand. Enter your taxable income excluding any profit from Bitcoin sales.

Enter the date you sold the cryptocurrency and the price you sold it for the sale date needs to be within the tax year you selected. Select the tax year you would like to calculate your estimated taxes. Choose how long you have owned this crypto.

First there must be a taxable crypto transaction such as selling the cryptocurrency before it can be taxed. Choose your tax status. It takes less than a minute to sign up.

2 We help you categorize transactions Been trading on a DEX. Valid from 1126 to 1130. Verify that all historical data has been imported and that your crypto taxes are calculated properly.

1 Add data from hundreds of sources Directly upload your transaction history via CSV or API integrations. Get Started for Free. Written by Lisa Greene-Lewis Lisa has over 20 years of experience in tax preparation.

Use our free cryptocurrency tax calculator below to estimate how much CGT Capital Gains Tax you need to pay on any cryptocurrency sales you made this financial year. This calculator is for any crypto traders operating as a business or professional trader. Blox supports the majority of the crypto coins and guides you through your taxation process.

The basis of an asset is its cost to you the amount you paid for it or the sale price at the time of purchase. Read on to find out how to calculate cryptocurrency taxes in a fuss-free way with a crypto tax calculator. There are cloud-hosting tools specifically designed for crypto miners.

Import all your cryptocurrency exchange trade history as well as any transactions made off-exchange. The formula is selling price minus cost basis equals capital gainloss. Enter the cryptos purchase date and price this is necessary to determine if it will be taxed as a short-term gain or a long-term gain.

Create your free account now. On this crypto gains calculator you see five different areas. Use our crypto tax calculator below to determine how much tax you might pay on crypto you sold spent or exchanged.

When selling or trading crypto you will have to take into account the cost basis the amount spent to acquire the crypto purchase price exchange fees and other relevant costs and the price you sold the crypto at to find your capital gains or capital losses. The Swyftx cryptocurrency tax calculator will ask you if youve held your crypto asset for 12 months. Ad From Simple To Complex Taxes Filing With TurboTax Is Easy.

Under Add A Sale. USA Your cryptocurrency tax rate on federal taxes will be the same as your capital gains tax rate. These are the basic steps of using a crypto tax calculator.

As a refresher short-term capital gains had a rate of 10 to 37 in 2021 while long-term capital gains had a rate of 0 to 20. For most people this is the same as adjusted gross income AGI. What if the cryptocurrency tax calculator shows a loss.

Select your tax filing status. The Taxes Owed are. Your Earnings Annual Salary Other Income Sources Gains from Crypto Sales Gains from Exchanging One Currency For Another Income from Staking Income from Mining Income from Air Drops Income from Other.

Well Help You Track Your Cryptocurrency Transactions And Report Them In The Right Forms. Crypto Tax Calculator Use our calculator to get an estimate of the taxes on your cryptocurrencybitcoin sales. Invest in 200 Coins and Tokens.

June 27 2022. Estimated Capital Gains Tax 0. Use code BFCM25 for 25 off on your purchase.

Crypto Tax Calculator Accointing Com

Capital Gains Tax Calculator 2022 Casaplorer

Crypto Tax Calculator

Crypto Taxes How To Calculate What You Owe To The Irs Money

Cryptocurrency Taxes What To Know For 2021 Money

How To Calculate Crypto Taxes Koinly

How To Calculate Crypto Taxes Koinly

Pin On User Interface

Crypto Tax Calculator

How To Calculate Cost Basis In Crypto Bitcoin Koinly

Cryptocurrency Tax Calculator Forbes Advisor

2021 Tax Plan Pricing Cointracker

Taxjar State Sales Tax Calculator Sales Tax Nexus Tax

How To Calculate Crypto Taxes Koinly

Crypto Tax Calculator Eztax

Capital Gains Tax Calculator Ey Us

Llc Tax Calculator